mississippi income tax rate 2021

2021 Mississippi Tax Tables with 2023 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator. If filing a combined return both spouses workeach spouse can calculate their tax liability separately and add the results.

How Do State And Local Individual Income Taxes Work Tax Policy Center

Phaseout of the 3 tax bracket is now complete.

. How do I compute the income tax due. Mailing Address Information. Choose the filing status you use when you file your tax return Input the total of your itemized.

The 2022 state personal income tax. Income and sales tax rates. Enter household income you received such as wages unemployment interest and dividends.

Eligible Charitable Organizations Information. Taxable and Deductible Items. Hurricane Katrina Information.

Its income tax system has a top rate of just 500. Mississippi Tax Brackets for Tax Year. 0 on the first 3000 of taxable income.

3 on the next 1000 of taxable income. Mississippi has a 700 percent state sales tax rate. If youre married filing taxes jointly theres a tax rate of 3 from 4000.

DEC 23 2021. 0 on the first 4000 of taxable income. Overall Mississippi has a relatively low tax burden.

Mississippi Single Income Tax Brackets. Calculations are estimates based on tax rates as of Dec. Proposed Individual Income Tax Phaseout.

Mississippi income tax rate. Mississippi has a graduated income tax rate meaning your income determines your tax rate. Compare your take home after tax and estimate.

Income Tax Calculator 2021 Mississippi 157000. Your average tax rate is 1198 and your marginal. Outlook for the 2023 Mississippi income tax rate is to remain unchanged.

Income Tax Laws Title 27 Chapter 7. IndividualFiduciary Income Tax Voucher REPLACES THE 80-300 80-180 80-107. 4 on the next 5000 of taxable income.

Starting in 2022 only the 4 percent and 5 percent rates will. The 2022 state personal income tax. If you make 70000 a year living in the region of Mississippi USA you will be taxed 11472.

Michigan state taxes 2021. Before the official 2022 Mississippi income tax rates are released provisional 2022 tax rates are based on Mississippis 2021 income tax brackets. In tax year 2021 only 1000 in marginal income will be subject to the 3 percent rate with the other 1000 exempt.

Overview of Mississippi Taxes. Mississippi also has a 400 to 500 percent corporate income tax rate. Combined Filers - Filing and Payment Procedures.

Tax Rate Brackets. 80-100 Individual Income Tax Instructions. Tax Calendar Dec 2022.

Mississippi has a graduated income tax rate and is computed as follows. A list of Income Tax Brackets and Rates By Which You Income is Calculated. Tax Calendar Nov 2022.

15 Tax Calculators. The graduated income tax rate is. Before the official 2022 Mississippi income tax rates are released provisional 2022 tax rates are based on Mississippis 2021 income tax brackets.

Income Tax Calculator 2021 Mississippi. In Mississippi theres a tax rate of 3 on the first 4000 to 5000 of income for single or married filing taxes separately. Mississippi Income Tax Calculator 2021.

Under current law in arriving at Mississippi taxable income a personal exemption of 6000 single filers 12000 joint. 5 on all taxable income over 10000. 71-661 Installment Agreement.

3 on the next 2000 of. 2021 and data from the. Tax Rates Exemptions Deductions.

State Sales Tax Breadth and Reliance Fiscal Year 2021. MS or Mississippi Income Tax Brackets by Tax Year.

Mississippi Ranks 30th In 2022 Tax Foundation State Business Tax Climate Index Mississippi Politics And News Y All Politics

Mississippi Tax Rate H R Block

Prepare Your 2022 2023 Mississippi State Taxes Online Now

States With The Highest Lowest Tax Rates

Mississippi State Taxes 2021 Income And Sales Tax Rates Bankrate

Mississippi State Tax H R Block

Printable Mississippi State Tax Form 2021 Fill Out And Sign Printable Pdf Template Signnow

Mississippi Plans To Tax Student Debt Relief But Paycheck Protection Program Loans Are Tax Exempt Mississippi Today

Which States Pay The Most Federal Taxes Moneyrates

2022 Capital Gains Tax Rates By State Smartasset

Mississippi Income Tax Calculator Smartasset

Study House Tax Proposal Increases Burden On Poor Mississippians Mississippi Today

Mississippi Income Tax Brackets 2020

How Racial And Ethnic Biases Are Baked Into The U S Tax System The Journalist S Resource

Michigan Income Tax Rate And Brackets 2019

State Corporate Income Tax Rates And Brackets Tax Foundation

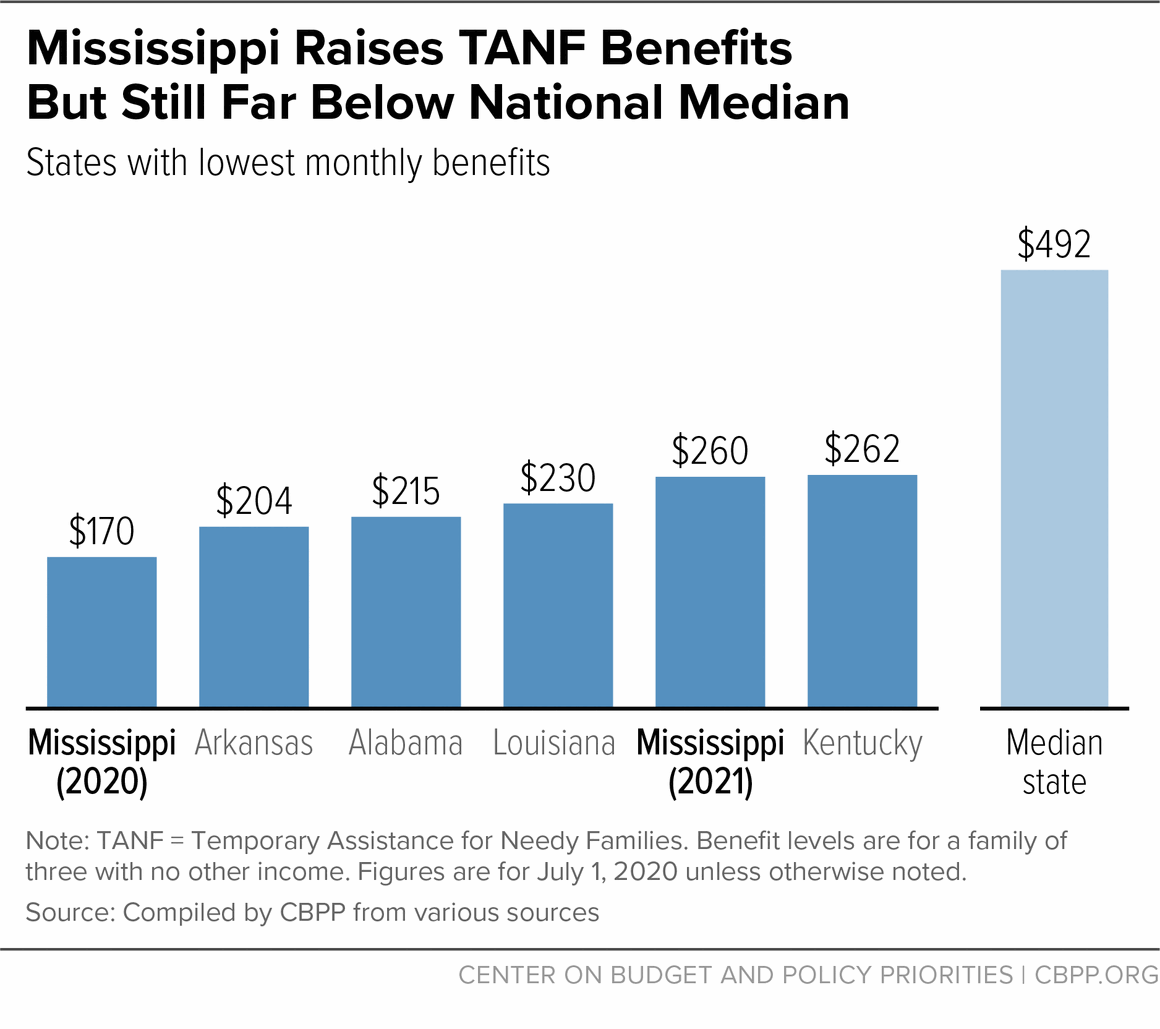

Mississippi Raises Tanf Benefits But More Improvements Needed Especially In South Center On Budget And Policy Priorities